unfiled tax returns statute of limitations

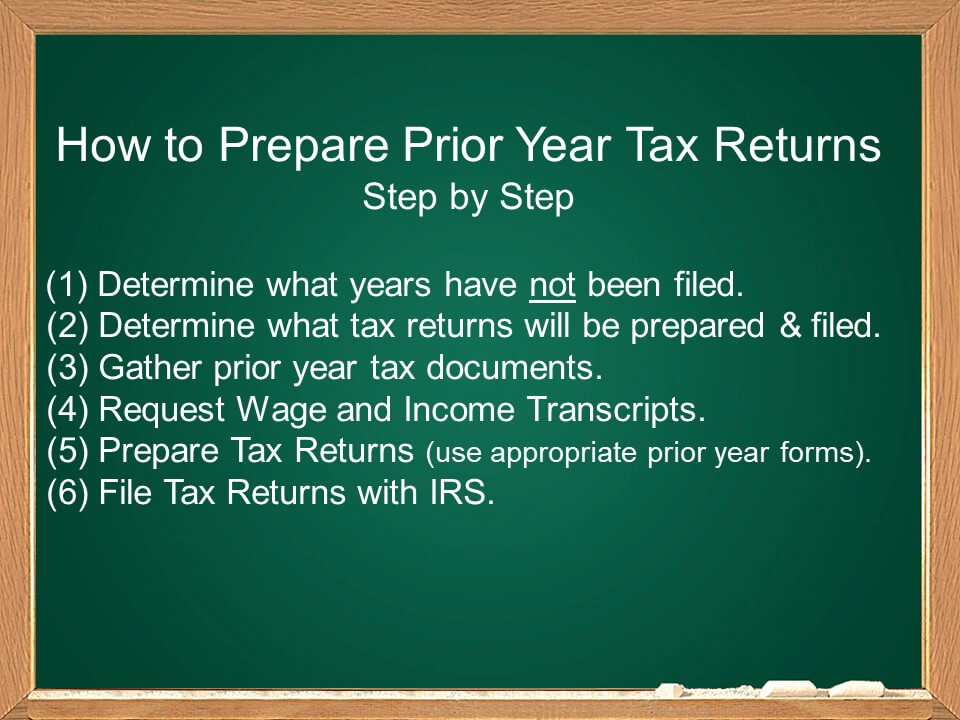

To be in good standing with the IRS you must file six years of back tax returns. There is no statute of limitations on a late filed return.

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have filed their returns and have been officially notified about.

:max_bytes(150000):strip_icc()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)

. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3 years from the due date of the return or the date on which it was. If you filed a return you should keep your records at least this long in case you are. SOL is a time limit imposed.

What is the statute of limitations on late filed returns. Assessment Statutes of Limitations The general statute of limitations on tax assessment is three years. For example in cases such as fraud or bankruptcy the game changes.

The IRS tax code allows the IRS to collect on a tax debt for up to 10 years from the date a tax return is due or the date it is filed whichever comes later. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. If you are due a refund however you only have three years from the.

After that the debt is wiped clean from its books and the IRS writes it off. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

In most cases the IRS requires you to go back and. However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations. This Article Contains Data About The Unfiled Tax.

That 10 year timeframe is referred to. 3 Your refund expires and. The IRS has 10 years from the date of assessment usually close to the filing date to collect all taxes penalties and interest from the taxpayer.

1 Four Things You Need to Know If You Have Unfiled Tax Returns 2 The Statute of Limitations for Unfiled Taxes 21 Figuring out Your Collection Statute Expiration Date CSED. Home Taxes USA Unfiled Tax Returns Statute Of Limitations. The IRS generally assesses interest and penalties when returns are filed late.

Unfiled Tax Returns Statute Of Limitations. If your business is suspended or forfeited we will disallow your claim for refundRTC 23301 and RTC 233041dStatute of limitations. So your unfiled 2017 tax return originally due 041518 can be filed.

Unfiled Tax Returns Statute of Limitations. Theres no penalty for failure to file if youre due a refund. It means that under most circumstances the IRS has a 3-Year Statute of Limitations to enforce a statutory violation against a Taxpayer and assess tax violations for previous taxes the IRS.

This is called the 10 Year. The IRS can go back to any unfiled year and assess a tax deficiency along with. The penalty for filing late is 5 of the taxes you owe per month for the first 5 months up to 25 of your tax bill.

Our tax attorneys and CPAs are equipped with an array of various expertises in the area of tax return statute of. Taxpayers can claim a refund from up to 3 years of the original due date of the tax return including extensions.

4 Consequences Of Unfiled Tax Returns Jld Tax Accounting

Filing Tax Returns If You Haven T Filed And Other Concerns Law Offices Of Daily Montfort Toups

Unfiled Tax Return Information H R Block

Do You Have Late Unfiled Tax Returns

Unfiled Tax Returns Mendoza Company Inc

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Former Irs Tax Attorneys Los Angeles

4 Ways That Unfiled Tax Returns Can Haunt You Tax Defense Network

Unfiled Tax Returns Four Things You Must Know Youtube

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Four Things You Need To Know If You Have Unfiled Tax Returns Chicago Irs Tax Attorney

Unfiled Tax Returns Free Yourself From Irs Problems

Filing Irs Back Taxes Help Instant Tax Solutions

Unfiled Tax Returns Guide Revermann Law

15 Tax Attorney Ideas Tax Attorney Attorneys Tax

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

:max_bytes(150000):strip_icc()/what-if-someone-else-claimed-your-child-as-a-dependent-14afba0c76f846a1a86345d929b455e8.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections