franchise tax bd cast tax

If you havent filed your income taxes yet visit estimated tax payments. Thats the title they always use when theyre direct depositing it into your account at least thats what it is for me when I do taxes level 1.

Income Tax Preparation Bd Services

At 800 the annual tax fee can feel like a lot of money to a cash-strapped startup.

. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. Allow at least 8 weeks to receive the new refund check. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax.

شاهد المحتوى الشهير من المبدعين التاليين. LLCs that elect to be taxed as a corporation are subject to Californias corporate income tax instead of a. Jackson Hewitt Tax Service.

It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. Other missing dollar amounts may be caused by a refund offset. Deleted 6 yr.

Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. There are many similarities between issues that arise with federal income taxes and those that arise for California state income tax purposes.

I think in 2013 I did end up owing right around the amount that was deposited to the state and I paid it on some. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year. People can walk in any time the locations are open to get tax help and many locations offer late hours and weekend options for greater accessibility than their competitors.

Alden against proposed assessments of additional personal income tax and penalties in the total. اكتشف الفيديوهات القصيرة المتعلقة بـ franchise tax bd casttaxrfd على TikTok. Contact us about refunds Phone 800 852-5711 916 845-6500 outside the US Weekdays 8 AM to 5 PM Chat.

Use refund towards your estimated payments. Generally the state or the IRS will send a letter notifying you of the changes. A franchise tax is a tax imposed on companies that wish to exist as a legal entity and do business in particular areas in the US.

But complete uncertified election results posted by louisiana secretary of state kyle ardoins office showed 52 of the more than 410000 voters who cast ballots opposed the sales tax measure and. For LLCs the franchise tax is 800. For the taxable year ending December 31 1941 it reported to the Franchise Tax Commissioner its net income and paid a tax thereon.

Franchise tax bd 463 us. This calculator does not figure tax for Form 540 2EZ. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web Accessibility Initiative of the World.

Attorney at Law For Respondent. York statute that imposed an annual franchise tax on a foreign manufacturing and mercantile corporation for the privilege of doing business in the state. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web Accessibility Initiative of the World.

Franchise Tax Board on the protest of Milton and Helen Brucker against a proposed assessment of additional personal income tax in the amount of 10363982 for the year 1973-428-For Appellant. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. Jackson Hewitt Tax Service made a smart move when it started placing many of its locations inside Walmart stores.

In 2020 some of the states that implement such tax practices are. You may receive this payment if you make. Its your tax refund from the state.

Do not include dollar signs commas decimal points or negative amount such as -5000. Small Biz Attorneythelegalpreneur Karlton Denniskarltondennis Gavin Larnardgavinjlarnard MoneyManMyersmoneymanmyers Theresa Van Damtheresavandamstylist. It represents the many ways that OTR is at the forefront of.

Action of the Franchise Tax Board we are of the opinion that none of the grounds set forth in the petition constitute cause for the granting thereof and accordingly it is hereby ordered that the petition be and the same is hereby denied and that our order of August 19 1975 be and the same is hereby affirmed. If you are starting a business in California you may be surprised to learn that California business entities must pay a minimum franchise tax to the state each year even if the business is inactive or loses money. The tax was computed by the State Tax Commission at the rate of three percent upon the net income of the corporation for the preceding year.

The refund amount changing could mean that the IRS or your state adjusted your return based on information that they had that is different than what you reported. Thats really a long delay for a CA tax refund but congrats use it fun-ly. The Franchise Tax Board FTB is the California tax agency that collects and enforces state income tax assessment and collection.

In many situations the FTB operates similarly to the Internal Revenue Service IRS. The system houses individual income business and real property taxes and fees administered by OTR. As such it was subject to franchise taxes imposed by the Bank and Corporation Franchise Tax Act Deerings Gen.

These appeals are made pursuant to section 18593 of the Revenue and Taxation Code from the action of the Franchise Tax Board on the protests of John C. Ach credit franchise tax bd casttaxrfd i have just received a direct deposit for tax exemption. About MyTaxDCgov MyTaxDCgov is the Office of Tax and Revenues OTR online tax system.

Did you take the Standard Deduction on your 2019 Federal return. However some states no longer impose the franchise tax. 3 If the entire.

Knopke Counsel Allen R.

California Ftb Rjs Law Tax Attorney San Diego

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

What Is Franchise Tax Bd Casttaxrfd Solution Found

Journal Of Property Valuation And Taxation Aspen Publishers

Income Tax At A Glance National Board Of Revenue

Income Tax At A Glance National Board Of Revenue

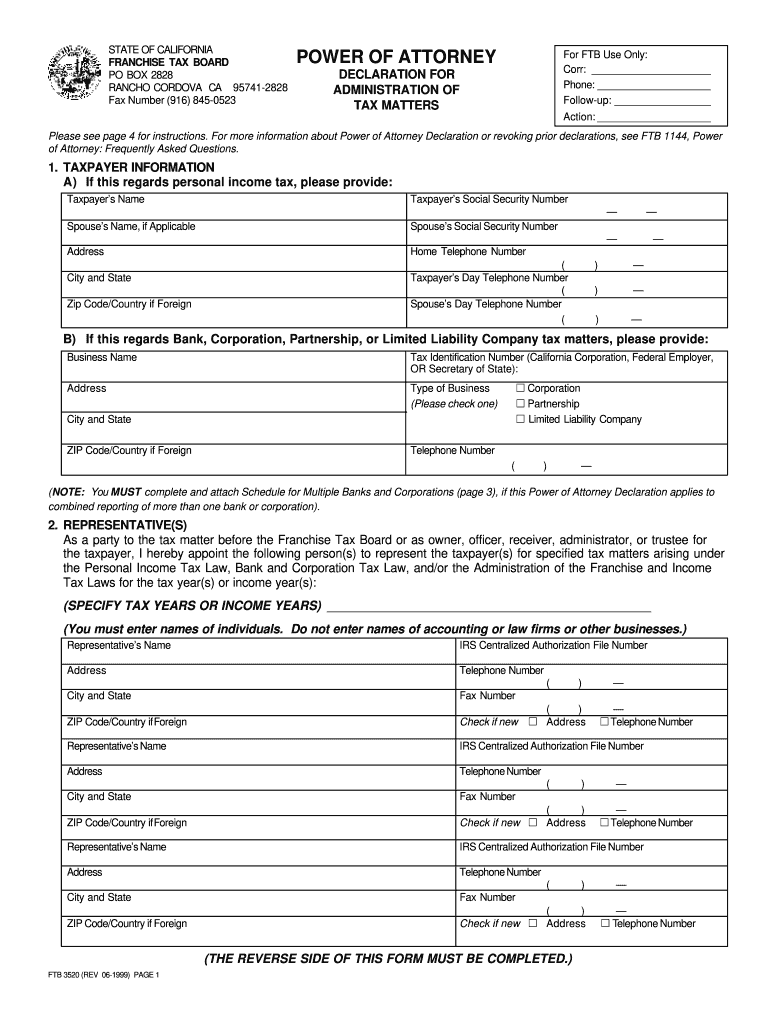

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

The Income Tax Rules 1984 Updated Up To July 2021 Pdf Tax Deduction Taxes

Samsung Galaxy A51 Tax Customs Duty In Pakistan Phoneworld

Pdf Beps Principal Purpose Test And Customary International Law

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento